Financial markets keep going. US stocks reached now all-time highs. Other equities are close or at least trending higher. Yields are nearly unchanged.

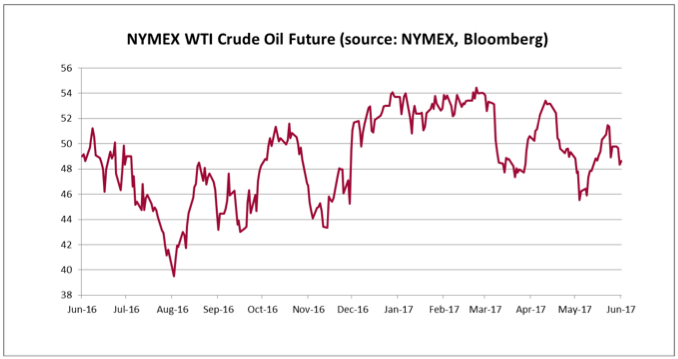

Last week Organization of Petroleum Exporting Countries (and some NOPEC countries) met in Vienna to extend crude oil output cuts for another nine months beyond June. Saudi Arabia accounts for most of the cuts and expects a simple extension of the existing program will be sufficient. Crude oil prices dropped 2.5% on the day of the announcement. OPEC delivered what they said. However, obviously investors expected stronger measures such as a deeper cuts, a longer period or more countries involved.

Not all OPEC countries bear an equal share of production cuts. Libya and Nigeria take no cuts and Iran is allowed to increase. So the group is quite heterogeneous. And not all countries abide by the rules agreed on. Iraq pumped about 80,000 more barrels of oil a day than permitted by OPEC curbs during the first quarter. For Iraq it is particularly hard to comply. Production capacity at key southern fields is expanding and three years of fighting Islamic state has left it drowning in debt. Saudi Arabia might continue to absorb this shortfall of production cuts. If Iraqi compliance worsened to such an extent that other countries in the 13-member group start cutting corners too then there would be significant risk for the whole deal to fail. There is no punishment mechanism within OPEC to enforce the agreement.

At the same time US shale production keeps increasing. Even deep drilling experiences significant productivity gains which bring down break-even price from $75 in 2014 to $50 in 2017. And last but not least, Donald Trump proposes selling off half of U.S. strategic oil reserves which currently hold 687 barrels of oil in salt caverns and tanks at designated locations in Texas and Louisiana. The reserve allows for quick distribution when natural disasters or unplanned accidents occur. The amount equals more than 30 days of total U.S. consumption or nearly 7 days of total world production.

Despite those downside factors Erwin Lasshofer and his INNOVATIS team still see a good chance for the OPEC cartel to stabilize energy prices at current level. We continue to seek investment opportunities also in this sector. Ask for tailored structured notes or for full service in our managed account.